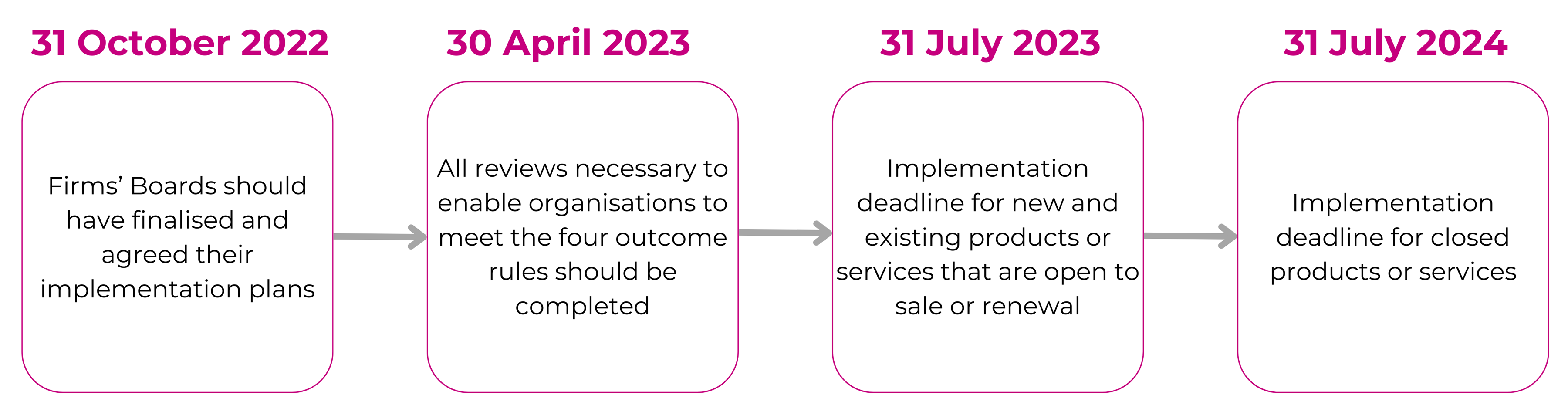

Firms have now been living with the FCA’s Consumer Duty for almost 12 months, and are now looking ahead to the implementation deadline for closed products or services at the end of July.

What have we observed so far?

We’ve seen firsthand from our clients the effort that’s been put into open products over the last year and the difference this has made to management of customers who are in arrears (the FCA has also noticed changes). We’ve observed:

- alignment of the culture between boards and customer facing agents

- system change requests being reviewed through the lenses of the Consumer Duty and vulnerable customers

- changes in suppliers to ensure solutions are fit for purpose under the Consumer Duty and to ensure customer inclusivity

- agents’ metrics being more aligned to customer outcomes

- more comprehensive change management processes to ensure compliance

- expansion and development of data to proactively detect compliance failures and ensure faster remediation.

Last month, the FCA issued a “Dear CEO” letter regarding the upcoming deadline for closed products, which they’re aware is proving more challenging for firms than open products. In this letter, they’ve promised to act “swiftly and assertively” to prioritise the most serious of breaches that they identify and have also given guidance around priority areas for firms to consider which are more likely to be widespread or acute for closed products.

In this blog, I take a look at the areas most relevant to collections.

Gaps in data

Closed products are more likely to be held on legacy systems that inherently lack the same data and control capabilities as their modern counterparts. Regardless, closed products have the same expectations as open products under the Duty. Firms must be able to evidence how they are closing any gaps, cleansing existing data or providing other workarounds to demonstrate good outcomes.

Treatment of consumers with characteristics of vulnerability

Customer vulnerability has been a hot topic for the FCA, and the industry in general, for some years, with the FCA reporting that “almost half (47%) of adults show one or more characteristics of vulnerability”.

Linked to the previous point about data, as well as the nature of closed products in terms of product age and legacy systems, on top of customers’ circumstances and needs being more complex than ever, there is a high risk of customer harm if firms are unable to proactively identify a vulnerability and act on it appropriately and with care.

Firms should identify if there needs to be any enhanced processing or support for potentially vulnerable customers with a closed product. For example, does the closed product prevent or limit certain types of forbearance or product switching to better assist a vulnerable customer? Does the lack of data fields limit how vulnerable customers can be identified for more appropriate support?

Gone-away or disengaged customers

The FCA is stipulating that firms should take positive action to identify less engaged and “gone away” customers of closed products. These scenarios may be more acute for closed products due to customer age profiles.

The issue here is that lack of contact can lead to customer harm. The FCA doesn’t stipulate what efforts firms need to make in this regard and that the most appropriate course of action will depend on different factors and circumstances.

Firms will need to consider the actions they take, evidence why they took them and track the impact of the decisions with the sole purpose of delivering good outcomes for the customers involved.

The FCA’s expectations are as follows (in their own words):

- Firms should be prioritising their reviews and taking actions in areas where there is the greatest level of harm / potential for harm. As part of this prioritisation, they should consider where such harm might be affecting vulnerable customers.

- Firms should have clear, timebound, resourced plans to address any gaps in implementing remedies where they have identified these are needed to ensure good outcomes.

- Firms should put in place clear mitigations to protect customers from known or possible harms in the period until they have fully implemented identified improvements

- Firms' governing bodies should challenge their businesses on all the above.

- Firms should consider assurance work via an independent function, such as their internal audit function, on how they are implementing the Duty in due course.

Annual board report

Another looming deadline, which is also 31 July this year, is the annual report. The FCA states that “firms need to make sure they are learning and improving continuously and must be able to evidence this in their annual board report.”

- The purpose of this report is to outline a firm’s compliance with its Consumer Duty responsibilities. As part of the commitment to delivering good outcomes to customers, the report should include data and other evidence to support that good outcomes are being delivered.

- A Consumer Duty Champion should be appointed at the board level. This individual will collaborate closely with the Chair, CEO and other board members and senior management, to ensure that the Consumer Duty remains a priority in a firm’s strategic discussions.

- The annual board report should provide a thorough evaluation of adherence to the requirements of the Consumer Duty and should cover the four key outcomes stipulated by the FCA: products and services, price and value, consumer understanding and consumer support.

- To demonstrate compliance, supporting data and management information should be evidenced. This includes metrics related to customer outcomes, complaints handling, and any corrective actions taken.

- Any areas that are not compliant with the Consumer Duty should have a comprehensive plan of action to correct the position and which can be evidenced with dates, milestones and resources. Apart from remediating the process, a firm should also undertake analysis of customer impacts and be prepared compensate / support impacted customers, financially or otherwise, if they have suffered harm.

This report is critical to get right and will set the tone for ongoing discussions and collaboration with the FCA. Hopefully these reports are nearing finalisation and being finetuned – time is running out!

With under a month to go, most firms will have all this in hand, but a timely reminder to focus attention is always helpful.

If you have any concerns regarding compliance with the Duty from a collections perspective, or want to discuss any of the points raise here, feel free to contact me directly.

Read an overview of Consumer Duty

Read our comprehensive guide to Consumer Duty

Find out the difference between TCF and Consumer Duty

About the author

Nick Walsh

Principal Consultant

Arum

Nick, a seasoned collections and recoveries professional, boasts over four decades of experience both domestically and internationally. His expertise has empowered numerous organisations, spanning various sectors and sizes, to swiftly adopt an optimal operating model tailored to their unique needs. This tailored approach carefully balances regulatory compliance with organisational limitations, whilst charting a more strategic roadmap for improvement. Nick, and Arum, ensure good outcomes for customers are prioritised in all the client engagements we undertake.